Condo Insurance in and around Fort Worth

Welcome, condo unitowners of Fort Worth

Protect your condo the smart way

There’s No Place Like Home

Because your condo is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or weight of snow. That's why State Farm offers coverage options that may be able to help protect your most personal possessions.

Welcome, condo unitowners of Fort Worth

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Vince Adams is ready to help you prepare for potential mishaps with reliable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Vince Adams can help you submit your claim. Keep your condo sweet condo with State Farm!

If you want to find out more information, State Farm agent Vince Adams is ready to help! Simply call or email Vince Adams today and say you are interested in this excellent coverage from one of the top providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Vince at (817) 377-3401 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

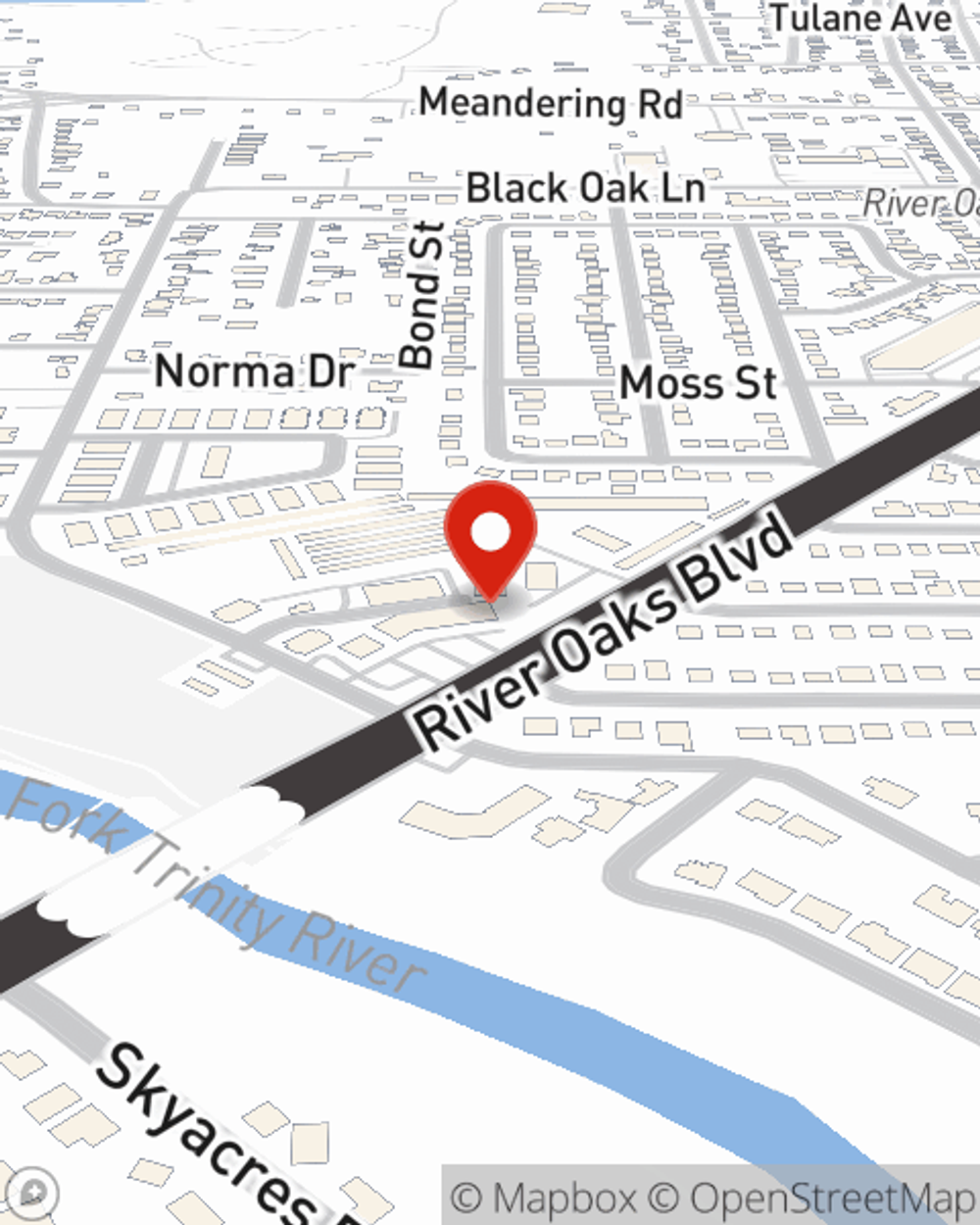

Vince Adams

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.